arizona vs nevada retirement taxes

Taxes on Retirement Benefits Vary By State As of 2022 eleven states have no tax on regular or retirement income. Nevada No income tax low cost of living and warm weather.

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation

Texas No income tax super low cost of.

. This is a huge benefit for individuals nearing retirement and a reason many of them are flocking to the Silver State. Arizona rose from the ninth spot last year to the third-best state for retirement for 2022. Discover whats next Call Us.

Retiring in Nevada comes. Arizonas income tax rate runs between 259 and 450 and this unfortunately includes retirement income. Property taxes in Nevada are.

Our blog has the latest news trends and insights about over 2000 active adult retirement communities in the US. In Nevada too the situation is similar. By comparison Nevada does not tax any retirement income.

Arizona Low state income tax low cost of living and warm weather. Use this tool to compare the state income taxes in Arizona and Nevada or any other pair of states. How Arizona Property Taxes Work.

Arizona Vs Nevada Where S Better To Retire 20000 for those ages 55 to 64. Dont miss the first Florida vs. This tool compares the tax brackets for single individuals in each state.

However there are a few places that are more expensive. However Arizona does charge state income tax as well as taxes on most retirement sources. Arizonas cost of living is below the national average and homes can be found at favorable prices.

Nevada is also devoid. Any Federal retirement income. If you want to know more about the pros and cons of.

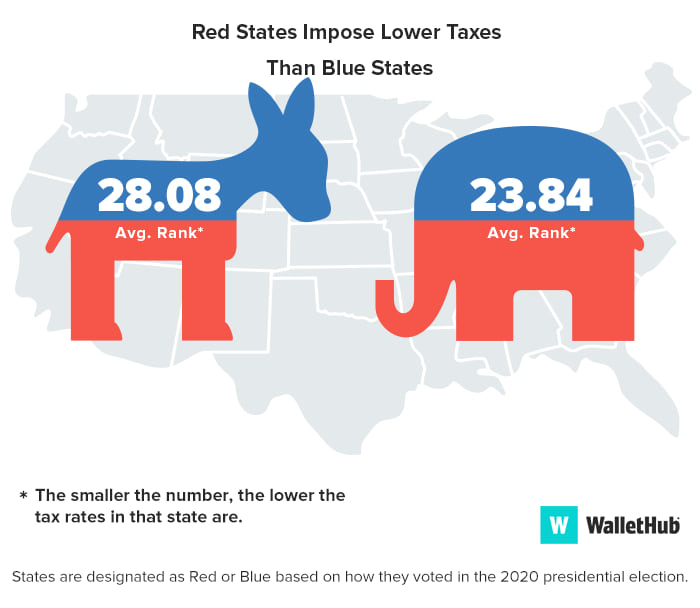

Alaska Florida Illinois Mississippi Nevada New Hampshire Pennsylvania. Average property tax 607 per 100000 of assessed value 2. The tax burden in Arizona is small compared to that of other states because of its lower.

Such as 401 ks and IRAs hence the moderate tax-friendly label. Nevada might be the better choice in this instance considering it doesnt have a state income tax compared to Arizonas reasonably low state income tax of 2598. Distributions from retirement savings accounts like a 401 k or.

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

Moving To A No Income Tax State Is An Expensive Way To Save Money Bloomberg

Which States Are Best For Retirement Financial Samurai

Arizona Vs Nevada For Retirement 2021 Aging Greatly

States That Don T Tax Military Retirement Turbotax Tax Tips Videos

Arizona Vs Nevada For Retirement 2021 Aging Greatly

Moving To Arizona Here S Everything You Need To Know

Which States Are Best For Retirement Financial Samurai

Which States Are Best For Retirement Financial Samurai

2022 Best States To Retire In For Tax Purposes Sofi

Want To Retire In Arizona Here S What You Need To Know Vision Retirement

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute

Retiring In Las Vegas Is Absolutely Awesome Redrock Wealth Mgmt

States With The Highest Lowest Tax Rates

5 Good Reasons To Retire In Nevada

Arizona Retirement Tax Friendliness Smartasset

Arizona Vs Nevada For Retirement 2021 Aging Greatly

Arizona Tax Rates Rankings Arizona State Taxes Tax Foundation